|

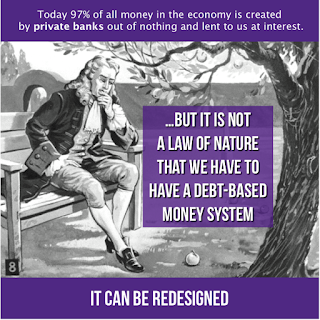

| No interest funding |

Taxes should only be used by States and local Governing units to raise money to fund spending. They are not Sovereign entities and cannot create money to spend or repay debt. The National Sovereign government does not have to balance budgets. Local Government does.

The National Sovereign Government should only tax for three reasons:

The National Sovereign Government should only tax for three reasons:

- To repay Treasury issued interest-bearing debt.

- To cause the use of dollars to be Necessary for the economy.

- To achieve good social behavior purposes.

All other National Government funding should be done by having the Federal Reserve System create it in the exact amounts requested by Congress at the appropriate time as needed. That money should be loaned to the US Treasury at 0% interest to fund specific programs. It should be repaid at the rate of 1% of the annual balance each year.

The only reason it needs to be repaid at all is to establish an accounting system for public transparency. The only control over appropriation should be the availability of labor, productive capacity, and input resources. That alone should be enough to avoid the likelihood of disrupting inflation.

The only reason it needs to be repaid at all is to establish an accounting system for public transparency. The only control over appropriation should be the availability of labor, productive capacity, and input resources. That alone should be enough to avoid the likelihood of disrupting inflation.